Excluding Live-In State Tax for Existing Employees

How to exclude live-in state tax for existing employees when an employee's live-in state is different than the work-in state and payroll taxes should be paid to the worked-in state.

OVERVIEW

Dual-state taxation setup should be used when an employee's live-in state is different than the work-in state and payroll taxes should be paid to the worked-in state. In order to Exclude the home location from generating a tax setup follow the steps listed below.

EXCLUDING LIVE-IN STATE TAX

To exclude employee state tax:

-

Log in to Namely Payroll.

-

Go to Employee > Search.

-

Use the search function to find the employee’s profile.

-

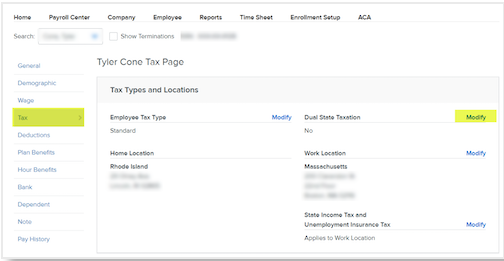

Click Tax on their profile page.

-

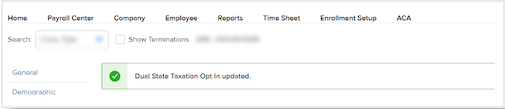

Click Modify next to Dual State Taxation.

-

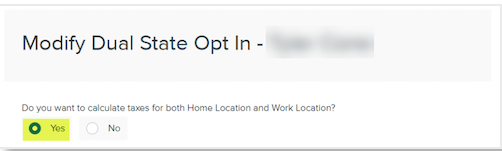

Select Yes.

-

Click Save.

-

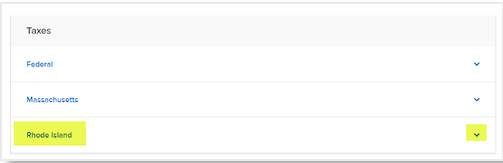

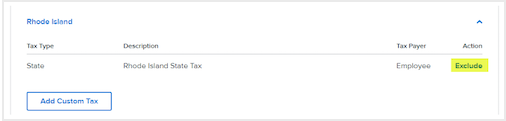

Scroll down to Taxes.

-

Select the state you want to exclude.

-

Click Exclude.

Note: Only take the steps listed below if the Exclude state should not be active in your company tax profile and you don’t expect tax liability for the state.

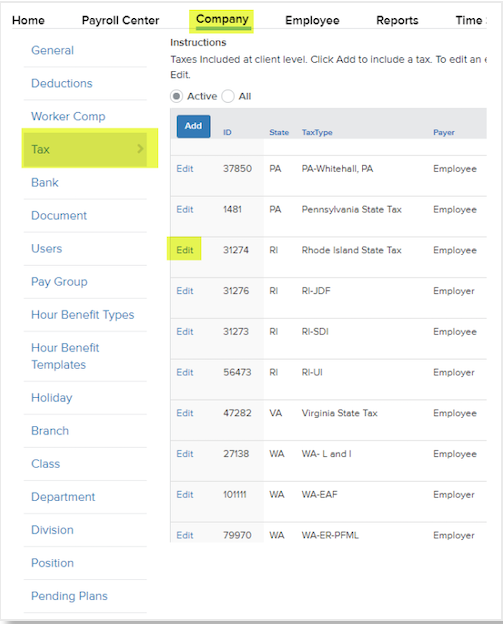

To exclude state tax on the Company level:

-

Go to Company > Tax.

-

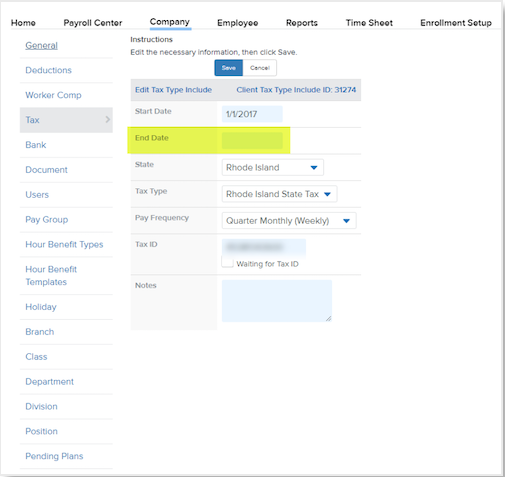

Select Edit.

-

Enter the End Date.

-

If the state was valid for a previous tax period, always end date as of End of Year (unless current year is zero). Example: enter 12/31/2019.

-

If current year is zero enter 01/01/current year. Example: 01/01/2019.

-

Invalid - Was an account number assigned by the agency?

-

If Yes Namely will need to file a final return and possibly an annual return. Please use 1/1/next year as the date. Example 01/01/2020.

-

If No enter 01/01/current year. Example 01/01/2019.

-

-

Click Save.

After you've completed the edits in Payroll, please send submit a case in the Help Community to inform your Pod Service members of these changes.

DISCLAIMER: Should the employee become liable for state tax withholding in the excluded state, it is the employer’s responsibility to remove the exclusion. Please see the Namely Toolkit: Tax Services for additional guidance.